Precious metals are valuable assets with a long history of use, primarily in financial transactions. Of all the precious metals, gold has been the most preferred, with variations being from gold coins and gold bars to one-kilo gold bars. Gold is liked for its preservative characteristic and normally has a better run during recessionary periods. Whether you purchase small bars like 2.5 gram gold bars or bigger ones like 5 oz or kilo gold bars, gold will always generate good profits along with liquidity flexibility.

Purchasing gold bars is a reasonable proposition for those aiming at diversifying portfolios because gold is a rare and valuable metal. Now, as a result of the financial crisis of 2008, the need for a free-floating investment range became permissive for overcoming internal and external market fluctuations and volatile, inflation-eroding fiat currencies.

Among the various options available, 2.5-Gram Gold Bars are an appealing option for people looking to establish or diversify their investing portfolio. These smaller bars usually have lower gross value premiums than larger options such as 10-ounce or kilo gold bars, helping investors profit from a risk-free investment.

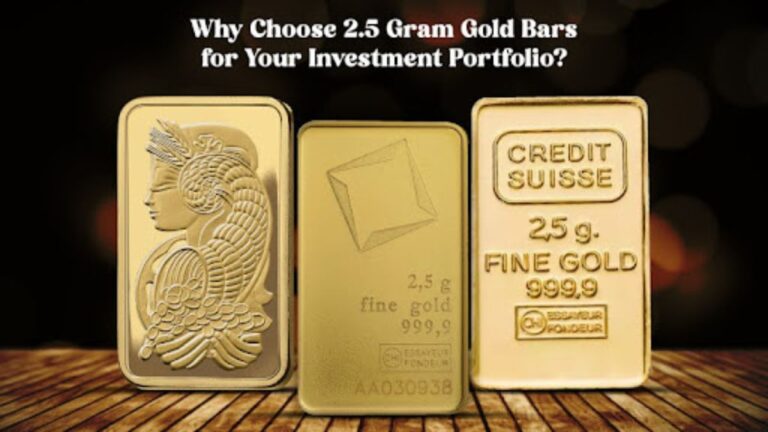

Popular 2.5 Gram Gold Bars Brand to Invest

2.5 Gram Gold Bars are affordable forms of investment-grade gold bullion, small in size and easy to handle. The value of 2.5 gram gold bars depends on the spot price of gold in the current market and includes premiums imposed by different manufacturers. These bars are bought from authorized bullion dealers and mints across the globe. Some of the prominent brands are:

Valcambi Suisse

Valcambi Suisse is one of the leading refineries in the world, and it is famous for its high quality, or rather, high purity production processes, which results in .9999 pure gold units. Some of their elegantly manufactured merchandise consists of cast ingots, such as the 2.5-gram bar with an exterior surface that is utterly smooth.

Every single bar is accompanied by an assay card, which contains information about the specific ingot. On the front side of the bar, one would find the weight, purity, metal type, assayer’s mark, and the famous spinning square to symbolize the mint’s emblem. On the reverse side, there is an inscription of the company name ‘Valcambi Suisse’ engraved beautifully at the bottom left corner.

PAMP Suisse

Another reputable Swiss refinery is PAMP Suisse, which has made its reputation with the Lady Fortuna series of bars. These bars, which contain 2.5 grams of .9999 pure gold, are outfitted with Veriscan technology, which provides increased security against counterfeiting.

The front side depicts the Roman goddess of luck and wealth, Fortuna, scattering treasures through the horn of plenty. On the reverse view, it has the bar’s weight, its purity, an individual serial number, and the PAMP Suisse mint mark engraved on it.

Credit Suisse

Credit Suisse is one of the most recognized precious metal refiners and mints in the world, and it specializes in the production of gold bars. Their 2.5 Gram Gold Bars feature the Credit Suisse logo on the front. It also has other details like the weight, purity, and unique serial number. Their packaging is praise-worthy and makes handling the bars manageable for the owners.

Why Invest in 2.5-Gram Gold Bars?

Buying 2.5 Gram Gold Bars has several benefits over larger bullion options, such as 1-ounce gold bars. These advantages make them a tempting choice for a number of investors.

Low Cost Compared to Larger Bars

2.5 Gram Gold Bars are significantly more affordable than full 1-oz gold bars. These are the most cost-effective options to invest in gold. They give investors an opportunity to access the gold market without having to buy the large bullion bars that are more expensive.

High Liquidity

Liquidity relates to how easily a commodity may be sold. 2.5 Gram Gold Bars are incredibly liquid due to their precious metal content. Their high fitness makes the selling task easy in the bullion market.

Also, they are small, which makes initial investment less costly for buyers. Selling them doesn’t directly impact your gold reserves, as you can sell them in smaller units. This affordability simply comes with better marketability.

Beautiful Artwork

2.5 gram gold bars are not only financially beneficial but also visually appealing. Some bars have exquisite designs, such as Lady Fortuna, 2024 Dragon gold bars, that will appeal to collectors and investors. While gold coins are usually prized for their beauty, these bars demonstrate intricate craftsmanship and timeless elegance.

Conclusion

The purchasing of gold bars is most widely viewed as a strategy to diversify and mitigate risks associated with the fluctuating global economy as well as conflicts.

Traditionally, gold was depicted as a valuable commodity that can retain its value over time and is a hedge against inflation, currency fluctuation (depreciation), and other uncertainties.

Overall, 2.5 Gram Gold Bars are pretty famous due to factors such as affordability, portability, and liquidity. As an added advantage, they are capable of serving as a hedge to a portfolio.